CBAM Trial Phase Begins This Week

The Carbon Border Adjustment Mechanism (CBAM), a key part of the EU Green Deal, entered into force on 1 October 2023. The CBAM will eventually serve to expand the effect of the EU Green Deal’s low-carbon transition by increasing the price of importing carbon-intensive goods into the EU trading zone. These higher prices will serve as a lever to encourage decarbonization in supply chains around the globe and also allow the EU to achieve its 2030 and 2050 climate targets.

In the initial phase, the CBAM will cover quarterly reporting of embedded Greenhouse Gas (GHG) Emissions imports into the EU for companies producing goods in the following sectors for the Period 1 October 2023 to 31 December 2023:

- Cement

- Iron & Steel

- Aluminium

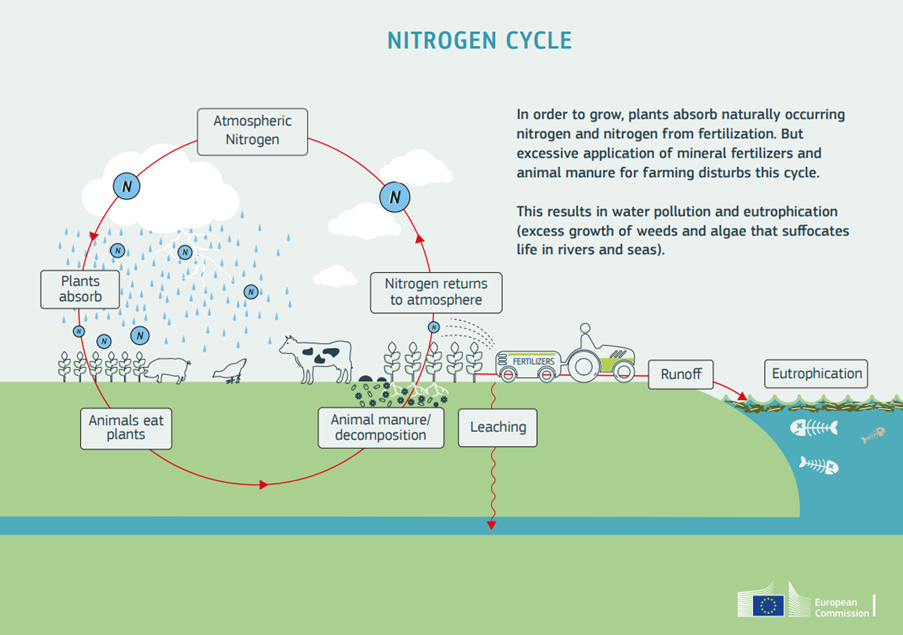

- Fertilisers

- Electricity

- Hydrogen

Emissions inside of reporting scope will include both direct emissions and indirect embedded emissions. Broadly speaking, direct emissions are the emissions produced by a company’s own fuel use, while indirect emissions are the emissions used to produce the power which a company uses to produce goods. Embedded emissions within scope in this case are those emissions created when precursor inputs to a business’ production process are made. In all cases, the unit of reporting will be tonnes of CO2 equivalent (TCO2e).

Source: Guidance Document on CBAM Implementation for Importers of Goods into the EU, 17.8.2023

The EU has developed IT tools to help importers measure and report their embedded GHGs.

At first, companies will be allowed to choose from one of the three following methods to calculate their embedded GHG emissions:

- Reporting based on the EU’s methodology (the ‘EU Method’)

- Reporting based on one of three selected methodologies deemed equivalent to the EU Method

- Reporting based on default reference values

From 1 January 2025, only the EU method will be accepted, with estimates only useable for complex goods if estimations represent less than 20% of total embedded emissions. From 1 January 2026, importers will be required to purchase and utilise certificates covering embedded GHG emissions for products sold into the EU in the previous year.

The financial times noted this week that as the UK’s carbon emissions prices have fallen to less than half of those in the EU in recent weeks following UK Prime Minister Rishi Sunak’s weakening of national climate commitments, that UK businesses will also face significant extra costs when importing into the EU as the CBAM is phased in if the UK’s carbon price does not increase to match that of the EU. (Article link: Clickable link— UK exporters face hefty EU carbon tax bill after Sunak weakens climate policies | Financial Times)

The EU has stated that it will revise and expand the list of goods covered by the CBAM in addition the six types of energy-intensive imports covered by the CBAM trial. The expanded list will be published before the full CBAM mechanism enters into force on 1 January 2026 and CBAM inclusion for the goods added to the expanded list will be phased in by 2030. This article from Bloomberg shows the emissions profile of Apple’s supply chain and discusses how it may be affected by CBAM

Our ISO14064 carbon accounting courses are certified by the Canadian Standards Association and can teach your business how to account for its GHG emissions to comply with the CBAM reporting requirements